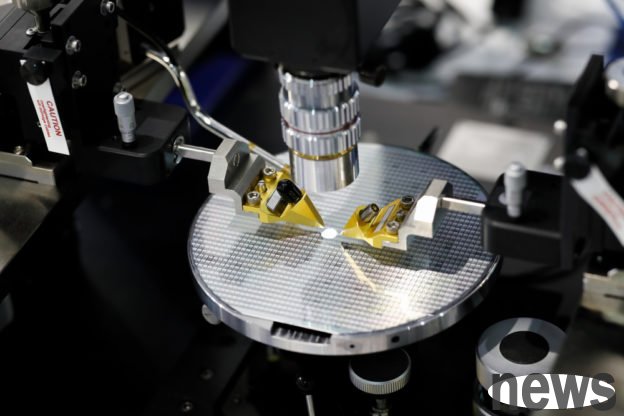

US President Trump has called for 100% of the semiconductor tax, and only investors who go to the United States can get exemptions. He mentioned in the conversation that this will attract a large number of technology factories to go to the United States, and also listed examples of investment in the United States, including Apple, NVIDIA and Taiwan Power. However, the current semiconductor tax has not yet appeared in detail. In the short term, the Taiwan-based semiconductor-related chemicals supply chain has low evaluation benefits for factories in the United States. The legal person expects to wait until the Taiwan Power US-based production scale has been stable and expanded before it will plan to evaluate the establishment of production capacity in the United States.

Today, the top-grade plate has been hit and stopped. The legal person pointed out that the main reason is that the top-grade product fluorin resin is mainly used in semiconductor pipes and other equipment, and is a direct beneficiary manufacturer for semiconductor manufacturers such as Taiwan Electric to go to the United States for production; new materials, Technological Materials, and Strike are important supply chains, and currently only indicate that customers' US factory demand will be supported by Taiwan. As a gas supplier, although it is more beneficial to supply nearby, Taiwan Specialty can currently enter the supply factors through the establishment of storage facilities in the United States.

Market interpretation Taiwan Electric's investment in the United States will become a future beneficiary manufacturer of semiconductor industry, and promote the stock prices of electronic chemical materials industry in today's market to rise simultaneously. Top-quality products have increased by 5.6%, Taiwan Specialty and New Materials have increased by about 5%, and Daxing Materials has increased by nearly 3%.

It is still unclear whether the US tax on chemical factories is suitable for use in semiconductor taxes, and the operator also said that customers are still responsible for it.