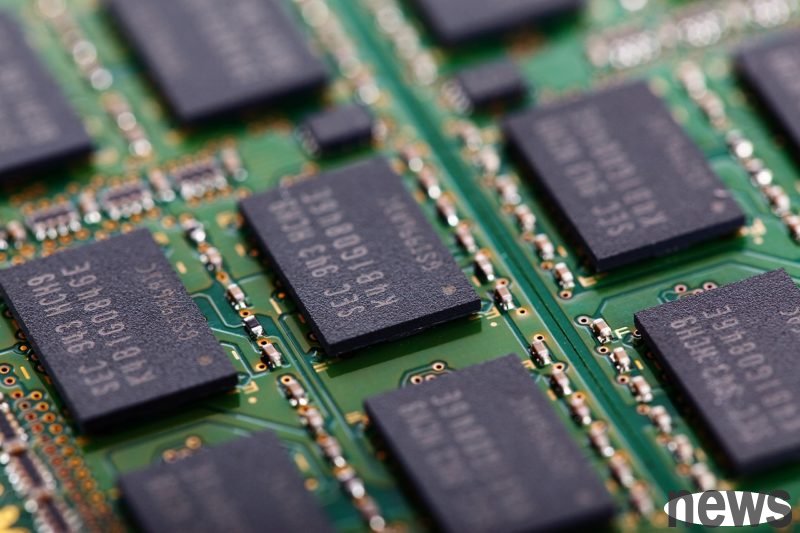

According to Reuters, the global frenzy in AI chip manufacturing is unexpectedly causing a shortage of traditional memory. As various chip factories focus their production lines on high-bandwidth memory (HBM) and AI acceleration chips, the general-purpose DRAM required for mobile phones, laptops, and servers has become in short supply.

Many distributors revealed that there has been an obvious rush for goods and repeated orders in the past two months, and the tight market conditions have caused prices to soar. Statistics from market research firm TechInsights show that DRAM spot prices nearly tripled in annual growth in September, much higher than the single-digit gains in the first half of this year. Analysts pointed out that this wave of "capacity dislocation effect" driven by AI has made Samsung, SK hynix and Micron the biggest winners.

Morgan Stanley estimates that cloud giants such as Google, Amazon, Microsoft, Meta and CoreWeave will spend a total of US$400 billion on AI infrastructure this year, driving demand for data centers and PC updates to emerge simultaneously. Tobey Gonnerman, president of Fusion Worldwide, pointed out that server manufacturers are purchasing DDR5 memory much faster than expected, and "prices are rising at an extremely rapid rate."

Jeff Kim, head of research at KB Securities, expects Samsung’s standard DRAM operating profit rate to be about 40% in the third quarter of this year. If the upward trend continues, the profit of non-HBM memory may even exceed that of high-end products in 2025. Taiwanese module manufacturers have also benefited from the shortage of DDR4, and the stock prices of the overall memory group have strengthened significantly in the past month.

However, the market still has reservations about this rally. Many analysts pointed out that although AI investment has driven the demand for semiconductors to a record high, there are also early signs of a "bubble". Some cloud and data center companies have expanded capital expenditures again before fully recovering their previous equipment investments, which has pushed up the prices of upstream memory and server components in the short term. TechInsights estimates that this wave of supply tightening may only last one to two years, and then the market will fall back as AI infrastructure enters the digestion period, with a downward cycle occurring as early as 2027.

The pressure on terminal manufacturers has emerged: Industrial computer manufacturer Advantech also admitted that rising DRAM prices are compressing profit margins. The industry is worried that if the AI capital expenditure boom fails to bring equivalent returns, this "AI super cycle" may eventually evolve into a typical bubble correction.

Chip crunch: how the AI boom is stoking prices of less trendy memory